Project Overview

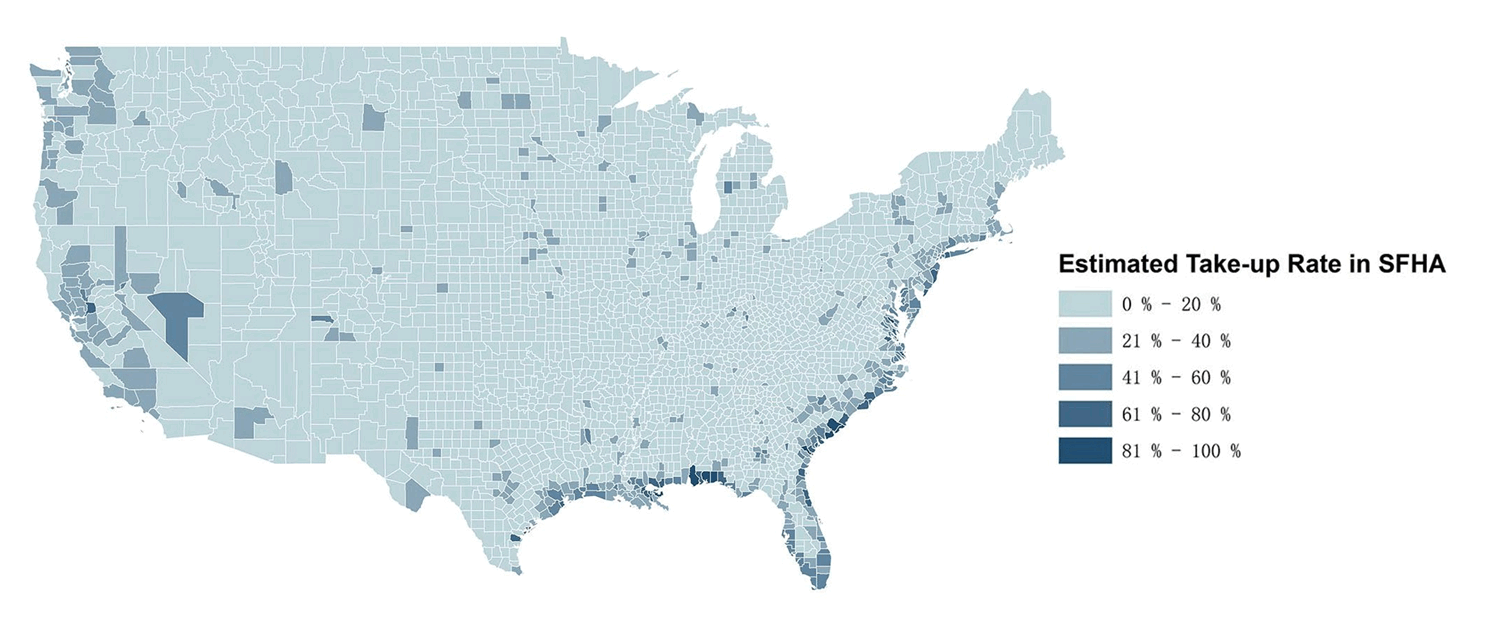

Flood insurance is a critical component of household and community resilience. It provides reliable funding to cover the costs of repair and rebuilding without the need to draw down savings, divert consumption, take on debt, or rely on often insufficient and delayed assistance from the federal government. Yet, many households at risk of flooding remain uninsured. On average nationwide, only 30% of homes in the highest risk areas have flood coverage. Less than 25% of the buildings flooded by Hurricanes Harvey, Sandy, and Irma had insurance. Indeed, repeatedly after floods there is evidence of the United States’ large and persistent flood insurance gap.

Flood insurance is a critical component of household and community resilience. It provides reliable funding to cover the costs of repair and rebuilding without the need to draw down savings, divert consumption, take on debt, or rely on often insufficient and delayed assistance from the federal government. Yet, many households at risk of flooding remain uninsured. On average nationwide, only 30% of homes in the highest risk areas have flood coverage. Less than 25% of the buildings flooded by Hurricanes Harvey, Sandy, and Irma had insurance. Indeed, repeatedly after floods there is evidence of the United States’ large and persistent flood insurance gap.

In October 2018, the Wharton Risk Center hosted a workshop designed to evaluate policy options for expanding the number of people with flood insurance in the United States, particularly those of low and moderate income. The workshop included roughly 50 experts across sectors and disciplines. Participants were divided into policy work groups to evaluate policy options for expanding the number of people with flood insurance. In the issue brief, Moving the Needle on Closing the Flood Insurance Gap, we provide an overview of the workshop and present seven approaches that participants felt had the potential to generate substantial increases in take-up rates across the country.

The workshop was supported by the Science and Technology Directorate of the US Department of Homeland Security for the Flood Apex Program under Contract HSHQDC-17-C-B0032. More on the Flood Apex program can be found here.

Estimated take-up rate of residential NFIP contracts in SFHAs, by county, February 2018