April 16, 2020

Erin St. Peter

As California begins its wildfire season, the question of how we pay for the damages and assist households and communities with their recovery becomes ever more critical. Wildfires are increasing in size and impact across the United States. According to data from the National Interagency Fire Center, while the number of US wildfires per year remains fairly constant, the total acreage burned and average fire size has increased over the last thirty years.

For homeowners with a standard homeowner’s policy or other property insurance, funds to repair or rebuild after a wildfire typically come from private insurance claims. Absent insurance or lacking sufficient coverage to meet their needs, most individuals directly impacted by wildfire events turn to federal assistance programs when they are authorized. Victims are usually first directed to the Small Business Administration’s (SBA’s) disaster loan program, which offers loans to victims for rebuilding. When they do not qualify, victims may turn to a grant program in the Federal Emergency Management Agency (FEMA). While these programs are valuable, they are also limited in their ability to help residents in disaster areas recover, particularly when households lack insurance, are credit-constrained, have low incomes, and/or suffer severe losses.

An Overview of SBA Disaster Loans and FEMA Individual Assistance

Individuals and businesses with properties in a federally declared or certified disaster area can apply for low interest disaster loans from the SBA and/or grants from FEMA’s Individual Assistance (IA) Program. Despite being administered by the Small Business Administration, approximately 80% of SBA disaster loans are made to individuals and homeowners as opposed to small businesses. For residential uses, SBA disaster Loans can cover uninsured personal property damages (e.g. car, clothing) up to $40,000 for owners or renters and real property damages up to $200,000 for repairs/restorations to rebuild a homeowner’s primary residence to its pre-disaster condition. For renters and homeowners in a position to take on additional debt, disaster loans can be a critical part of recovery. However, to qualify and continue in the application process for disaster loans you must meet the initial SBA income test to demonstrate the capacity to repay. Households below this threshold or lacking the ability to take on additional debt are referred to FEMA Individual Assistance for support.

FEMA provides several types of assistance, but the primary one for rebuilding damaged homes is the Individuals and Housing Program (IHP). In 2018, IHP grants were capped at a maximum of $34,900 (this number is indexed to inflation) to renters and owners to cover rental, repair, and replacement costs for uninsured needs not met though other forms of assistance like SBA disaster loans or insurance claims. Rental assistance can be provided to owners or renters displaced from their primary residence while repair and replacement assistance is reserved for owners. Replacement assistance is provided instead of repair assistance when the home has been destroyed. The small portion of IA assistance not provided through the IHP generally falls under the category of Other Needs Assistance (ONA) and can include temporary child care, transportation, and funeral assistance. For more information on these programs, see this 2019 CRS report and the Individual Assistance Program and Policy Guide.

Recovery from California Wildfires

The 2017 and 2018 wildfires in California set records. According to the National Interagency Fire Center, approximately 1.82 million acres were burned in California in 2018 and 1.27 million acres in 2017. According to the California Department of Insurance, insured losses from California wildfires to residential and personal property totaled $11.4 billion in 2018 and $8.8 billion in 2017. We examine the federal assistance for these wildfire events in more detail.

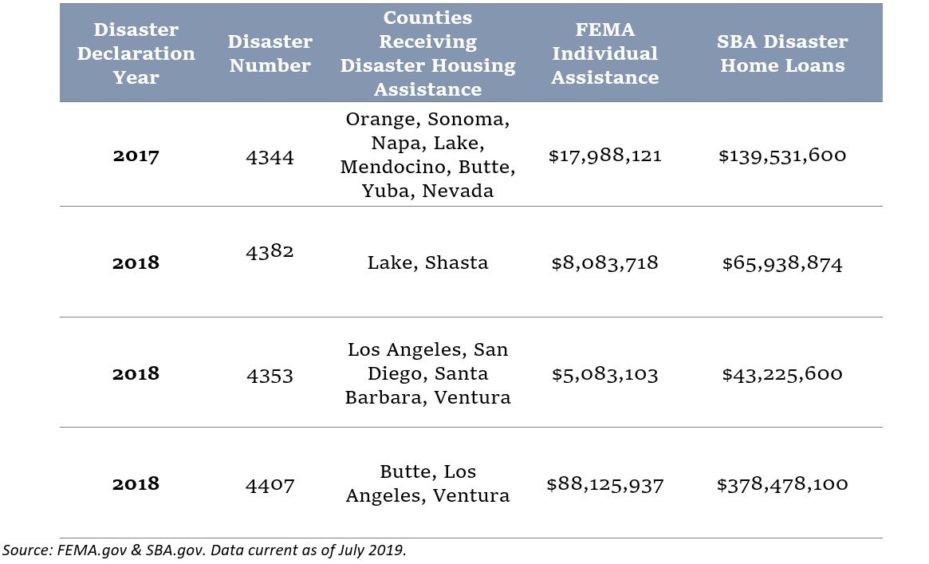

For these wildfire years, FEMA Individual Assistance funds represented much smaller amounts than that provided through the SBA Disaster Loan program. That is, substantially more of the federal assistance dollars provided to individuals for the 2017 and 2018 wildfires in California take the form of a loan rather than a grant.

Table 1: Total FEMA Individual Assistance and SBA Disaster Loan Funding for Wildfire Incidents in California (2017-2018)

Summary of FEMA IHP Grant Recipients

Because FEMA IA grant funds are intended for costs and damages not covered by any other source, it is important to understand the profile of these grant recipients.

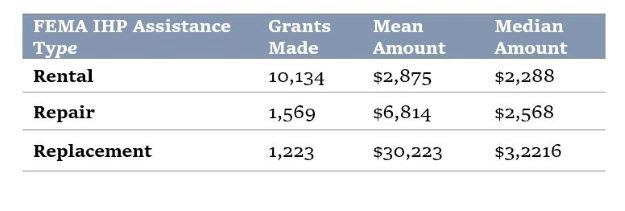

Grant Amounts & Types

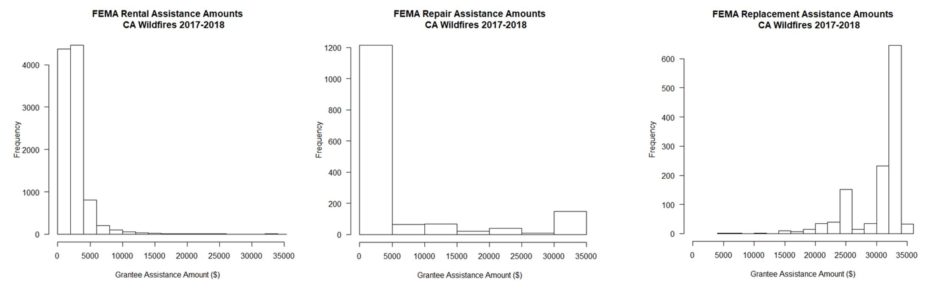

To explore the demographics of FEMA replacement, repair, and rental assistance grantees recovering from CA wildfire events, we examined publicly available data from FEMA on the 48,856 individuals applying for this type of assistance in California from 2017 and 2018. Of the total individuals applying for assistance, approximately 1/5 received some amount or combination of rental, repair, or replacement assistance funds. As is further illustrated in the table and histograms below, of the three types of assistance, rental assistance was the most common type received by individuals. However, per grant made, replacement assistance amounts were much larger than typical grant amounts for repairs or rentals.

Table 2: Total FEMA IHP Assistance by Type (California Wildfires 2017-2018)

Figure 1: Histograms of FEMA IHP Assistance by Type (California Wildfires 2017-2018)

Figure 1: Histograms of FEMA IHP Assistance by Type (California Wildfires 2017-2018)

These summary statistics make intuitive sense. Rental assistance grants should be more common given that they are available to renters and owners and the amounts should generally be lower given that recipients may only need help covering a rental unit for a short time. Given that the maximum dollar amount for FEMA individual assistance most likely would not cover total replacement costs for a fully destroyed, uninsured home, the fact that replacement cost amounts hover close to the maximum amount also seems intuitive.

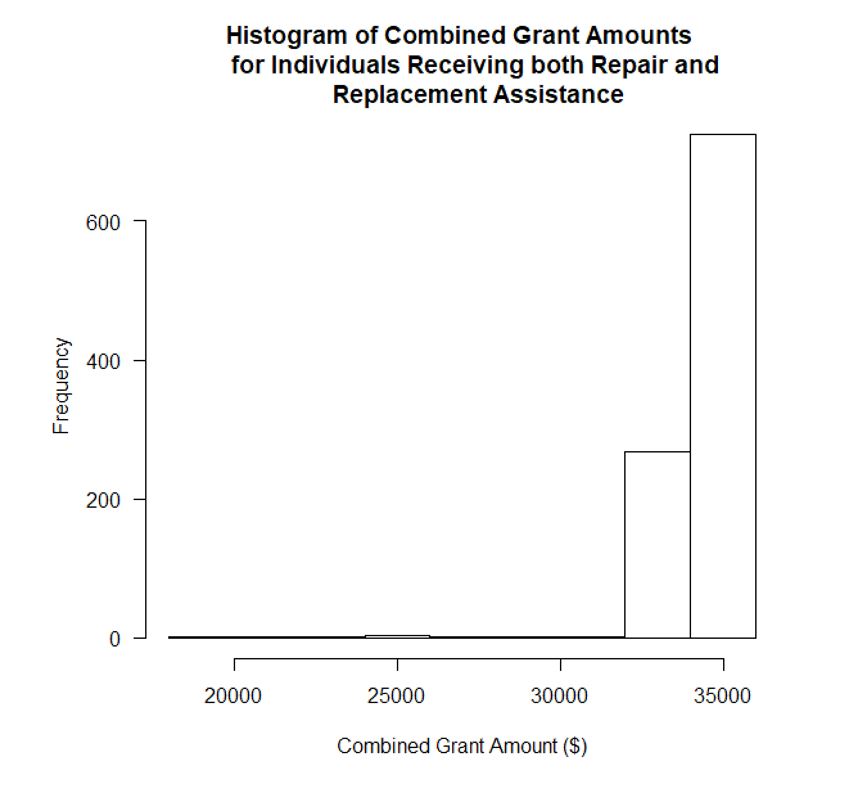

We also find that there is some overlap between the repair and replacement grant recipients. Approximately 15% of all funding recipients received more than one type of IHP assistance. Receiving more than one type of assistance was more common among repair and replacement grantees. For example, 98% of replacement grant recipients also received repair and/or rental assistance. The data suggest that for the majority of individuals receiving both repair and replacement assistance, the combination of these funds acts to “top up” total grant assistance to reach the maximum individual grant allowance for FEMA assistance, as shown in the graph below.

Figure 2: Combined Grant Amounts for Individuals Receiving both Repair and Replacement IHP Assistance (CA Wildfires 2017-2018)

Insurance Status & SBA Eligibility

Insurance Status & SBA Eligibility

Since homeowners insurance typically covers damage from wildfires, it is perhaps not surprising that most of the individuals receiving federal assistance in our sample were those that were uninsured. Of the 1,569 repair grant recipients, 19% had homeowners insurance. Out of the 1,223 replacement funding recipients, just 6.5% were insured. Similarly, only 6.1% of rental assistance grantees had homeowners insurance. This suggests that many insured homeowners did not utilize IHP assistance. For those that did, presumably, the federal aid met needs not covered in their insurance policy or by other assistance.

Not only were most IHP grantees uninsured but most IHP recipients with property damages were ineligible for SBA assistance. SBA loan eligibility for repair and replacement grantees hovered at 16% and 14%, respectively. While SBA loans can be enough to cover all property repairs, for uninsured homeowners, FEMA grant funding is insufficient to fully cover replacement costs of a heavily damaged home. This further emphasizes the importance of private insurance in comprehensive disaster recovery.

Damages

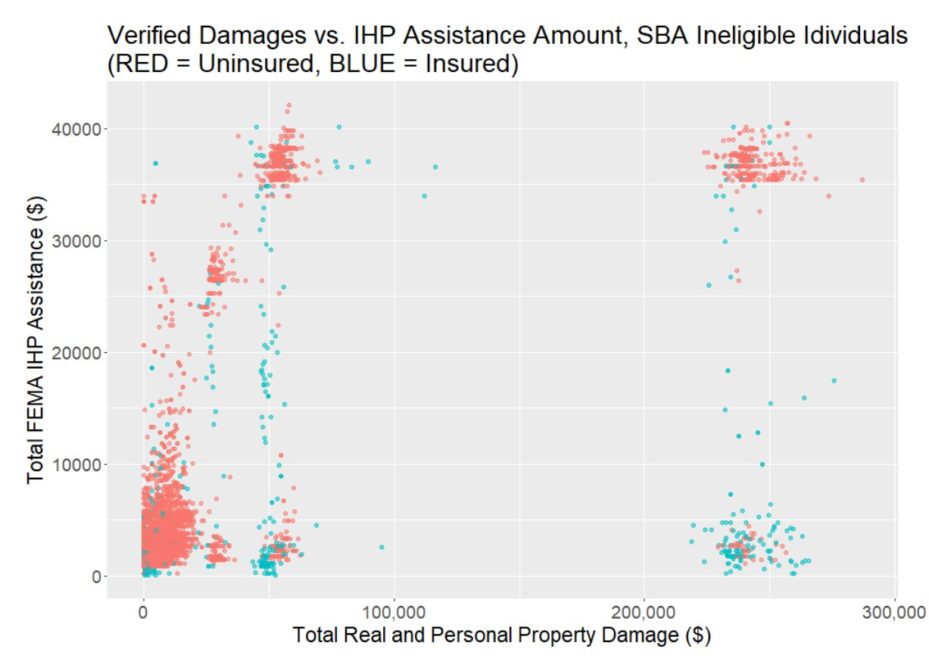

On average, households in the sample receiving IHP assistance incurred approximately $27,000 in combined real and property damage. Median damages were much lower, at $7,500 per household. To highlight unfunded damages within the sample of IHP grant recipients, the following plot compares total damages against IHP assistance for CA wildfire IHP recipients who were not eligible for SBA disaster loan funding.

Figure 3: Unfunded Damages in the Sample of IHP Grant Recipients (California Wildfires, 2017-2018).

Red observations on the righthand side of the graph are particularly striking, illustrating households receiving the maximum of FEMA IHP assistance ($34,900), yet experiencing damages in excess of $200,000 and lacking both insurance and eligibility for SBA assistance. Simply put, without insurance, many of the individuals in the sample above likely face substantial gaps recovering damages after recent wildfire events.

Income

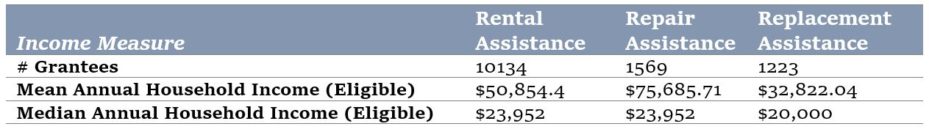

Median household income for IHP grant recipients was similar and quite low across assistance types, though mean income varied more substantially.

Table 3. Income of FEMA IHP Grant Recipients (CA Wildfires 2017-2018)

These data demonstrate that the typical replacement assistance grant recipient in this sample represents a low-income household lacking property insurance and eligibility for SBA assistance that would not be able to cover the costs of combined median personal and real property damage ($53,152) even if they received the full $34,900 FEMA grant amount.

Notes & Conclusions

It is important to note that FEMA IA grant funding for California wildfire recovery in this time period disproportionally went to one geography—the Town of Paradise. Given the particularly devastating nature of the Camp Fire that hit Paradise, one could argue that these data are therefore much more representative of Paradise than they are more broadly generalizable. However, the data still illustrate well the general notion that FEMA IA funds and SBA funds do not necessarily return affected households to their pre-disaster state, particularly when damages and numbers of destroyed homes are high.

Furthermore, it remains the case that most direct federal financial assistance to residents affected by wildfires who lack sufficient insurance to cover losses takes the form of a loan. As is intentionally stated in the program design, FEMA IHP grants, while certainly providing needed grant funds to individuals unable to borrow funds or capture losses through insurance, do not necessarily return properties to their pre-disaster conditions. The Disaster Recovery Reform Act of 2018 removed the limit on rental assistance amounts and established annual CPI adjustments for the limit on repair and replacement assistance, which may allow for modest increases in distributions of funds. However, the gaps between damages and FEMA grant amounts demonstrate the importance of private insurance and mitigation efforts for credit constrained and lower-income individuals in at-risk areas. Without insurance, many individuals in wildfire-prone areas likely have insufficient resources to recover from these devastating events.

* This should be interpreted as an oversimplified depiction of “unfunded.” For example, individuals also eligible for SBA assistance may also not have been able to cover the full cost of verified damages with the various types of assistance received.