March 29, 2018

Carolyn Kousky and Brett Lingle*

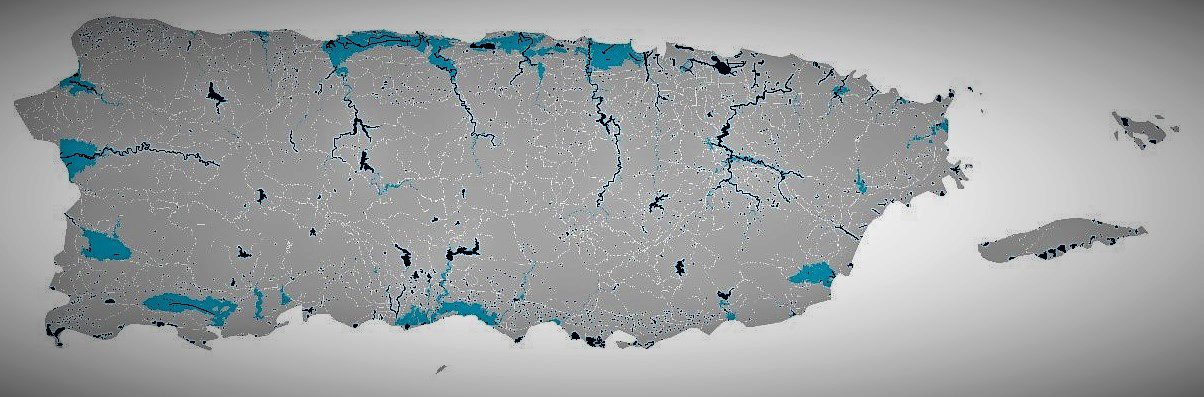

Flood insurance in Puerto Rico has attracted media and policymaker attention since Hurricanes Irma and Maria devastated the island in late summer 2017 (see here and here, for example). One reason is the incredibly low take-up rate for flood insurance, which left some residents financially vulnerable following flood damage from two back-to-back hurricanes. Another is the surprising shift over the last five years from the vast majority of flood policies being written with the National Flood Insurance Program (NFIP) to instead being written by private sector insurers. This shift has not occurred on the mainland U.S. and many stakeholders have been interested in understanding the drivers of the shift in Puerto Rico.

In a new issue brief, we examine recent trends in Puerto Rico’s residential flood market, documenting the flood insurance gap and examining the role of the private sector.

We find:

- Less than 4% of households in Puerto Rico have flood insurance.

- Over the last five years, the majority of residential flood insurance on the island has moved to the private sector from the National Flood Insurance Program (NFIP). Today, roughly 90% of residential flood insurance on Puerto Rico is private, compared to only 2% nationwide.

- Different construction practices that are not accounted for in NFIP rates are one reason the private sector can offer less expensive flood policies.

- Most residential, private flood insurance policies in Puerto Rico are written by so-called Write Your Own companies. They are able to compete with NFIP policies by coupling flood coverage with vandalism coverage and by offering higher coverage limits.

- The availability of private flood insurance in Puerto Rico has not led to greater demand. One contributing factor could be affordability challenges for roughly half of residents currently estimated to be living in poverty.

For more details, see the full Issue Brief available here.

*At the time of posting Brett Lingle was a Policy Analyst and Project Manager with the Wharton Risk Center.