August 2, 2018

Carolyn Kousky, Howard Kunreuther, Brett Lingle*, and Leonard Shabman

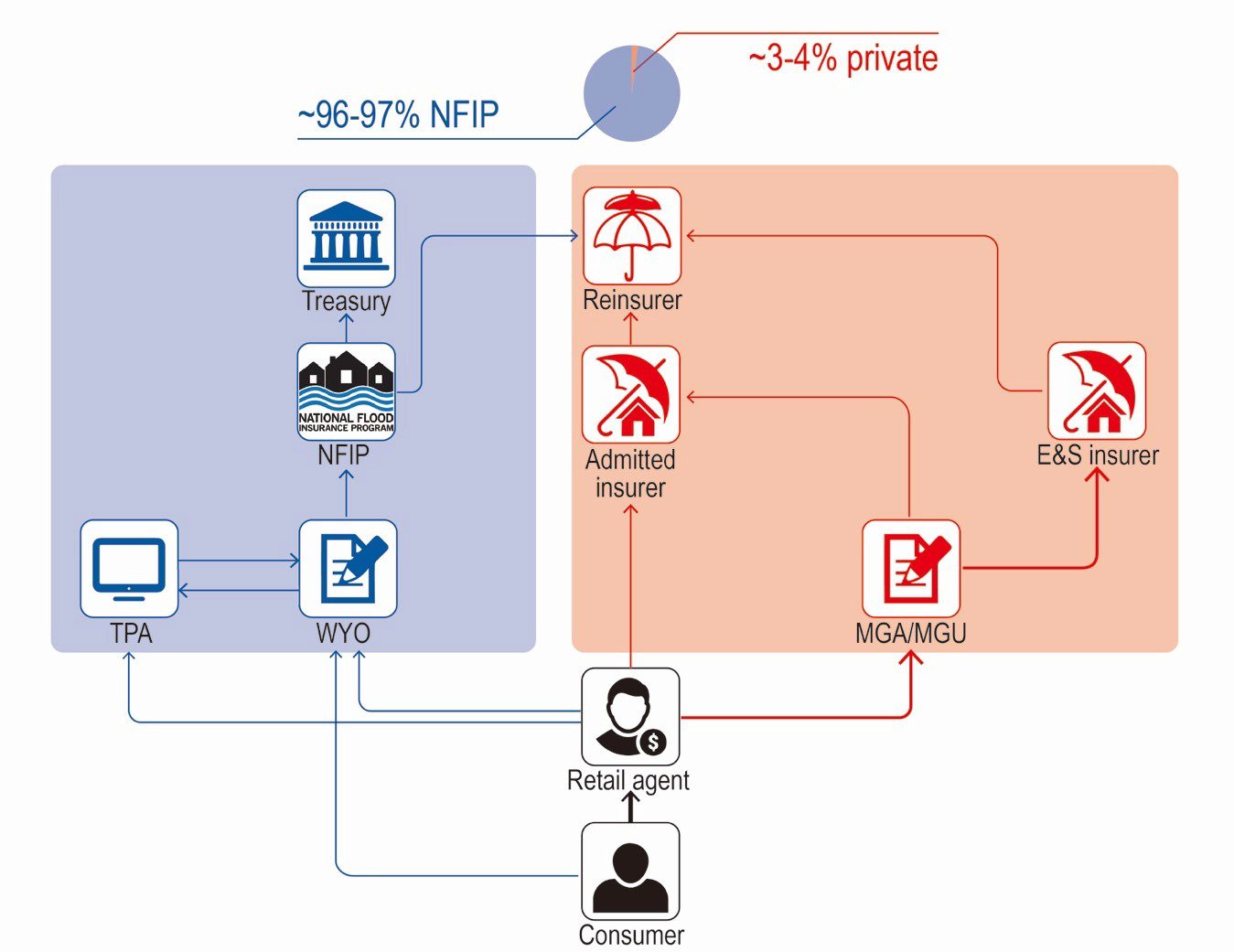

Since 1968, the NFIP has been homeowners’ only option for flood insurance, but over the past several years, a small private market for residential flood insurance has emerged. While it accounts for less than 5% of all residential flood policies purchased, the private market is growing and policymakers are increasingly interested in its expansion.

Drawing on our recent report, The Emerging Private Residential Flood Insurance Market in the United States, our newest issue brief describes the key players and structure of the residential flood market.

We find:

- Private flood insurance is available from both admitted insurers whose rates and forms are regulated by the states, and non-admitted insurers who have rate and form freedom but are still subject to solvency and market conduct requirements.

- Private market growth has largely been driven by global reinsurers. In the admitted market, reinsurers assume most of primary insurers’ risk, often in excess of 90%. In the non-admitted market, Lloyd’s of London backs the majority of residential flood policies.

- Consumers access the flood market through insurance agents. As such, agents should be well-versed in flood risk and in the offerings and mechanics of both private insurers and the NFIP in order to assist clients. Greater agent education may be needed in many locations.

For more details, see the full Issue Brief available here: Structure of the Residential Flood Insurance Market.

The complete report is also available here: The Emerging Private Residential Flood Insurance Market in the United States.

*At the time of posting Brett Lingle was a Policy Analyst and Project Manager at the Wharton Risk Center.