The ESG Initiative at the Wharton School

Turner ESG Student Blogs

The Power of Shared Ownership: How Employee-Owned Businesses Achieve ESG Goals

Turner ESG Fellow Kristin Tingle, W ’23 C’23, researches how employee-owned businesses perform against environmental, social, governance, and financial metrics.

As businesses continue to face increasing scrutiny for their environmental, social, and governance (ESG) practices, a growing number of companies are exploring alternative ownership models as a means of improving their sustainability and social responsibility. One such model that has been gaining attention in recent years is employee ownership.

Employee-owned enterprises are businesses in which employees hold a significant ownership stake in the company. This can take a variety of forms, including employee stock ownership plans (ESOPs), worker cooperatives, and mutuals, and they can vary in their proportion owned by employees. In an ESOP, for example, specific rules are set to govern corporate behavior, establish ownership expectations, and reinforce economic equity.

According to the National Center for Employee Ownership (NCEO), the number of employee-owned companies in the United States has been increasing steadily, with over 6,400 companies and nearly 14 million employees participating in some form of employee ownership as of 2020. This represents a significant increase from just a decade ago, when there were approximately 10 million employee owners in the US.

A few summers ago, I had the opportunity to intern with a large employee-owned firm in Kansas City, MO. Although interns such as myself were not eligible for many of the long-term benefits an ESOP provides, I was able to witness firsthand the commitment and engagement of its employees. Proponents of employee ownership argue that it can also lead to a range of advantages, including increased productivity, better employee engagement and retention, and improved ESG outcomes.

This year, in the Turner ESG Fellows program, I have had the opportunity to further engage with the topic of employee-ownership to gain a deeper understanding of the organizational model, including its benefits and challenges. Research suggests that employee-owned companies outperform their peers in a variety of areas, particularly environmental, social, and governance standards. However, these firms are not immune to traditional challenges and must grapple with their own unique complications.

Environment

First, employee-owned firms have shown significant commitment to improving environmental standards and sustainable business practices compared to peers. For example, the Journal of Business ethics recently published a study of over three thousand companies listed in China who implemented new ESOP plans between 2009 and 2019. Researchers found a significantly positive relationship between employee participation in ESOPs and greater environmental protection, quality of environmental impact information disclosed, and ESG ratings.

What is it about employee ownership that leads to these outcomes? Recent research finds that ESOPs enhance the employees’ capacity and willingness to hold their management accountable for environmental responsibility, thereby aligning long-term interests between employees and their executives. These researchers even found that employee ownership supports stronger environmental performance than providing environmental-based incentives in firms without ESOPs.

Social

Second, employee-owned firms particularly excel when it comes to social welfare for their employees and their communities. Employees at firms with ESOPs or other employee ownership structures experience increased job security and reduced workplace conflict. Employees with ownership shares also tend to have longer tenure, which has increased performance and allowed firms to maintain their standing even in times of market downturns.

In addition, ESOPs enable employees to have greater access to retirement benefits compared to the general US population. These plans help employees avoid debt by borrowing against accounts and helping with life investments such as education and home ownership, and they can create both real and perceived economic stability for employees and their families.

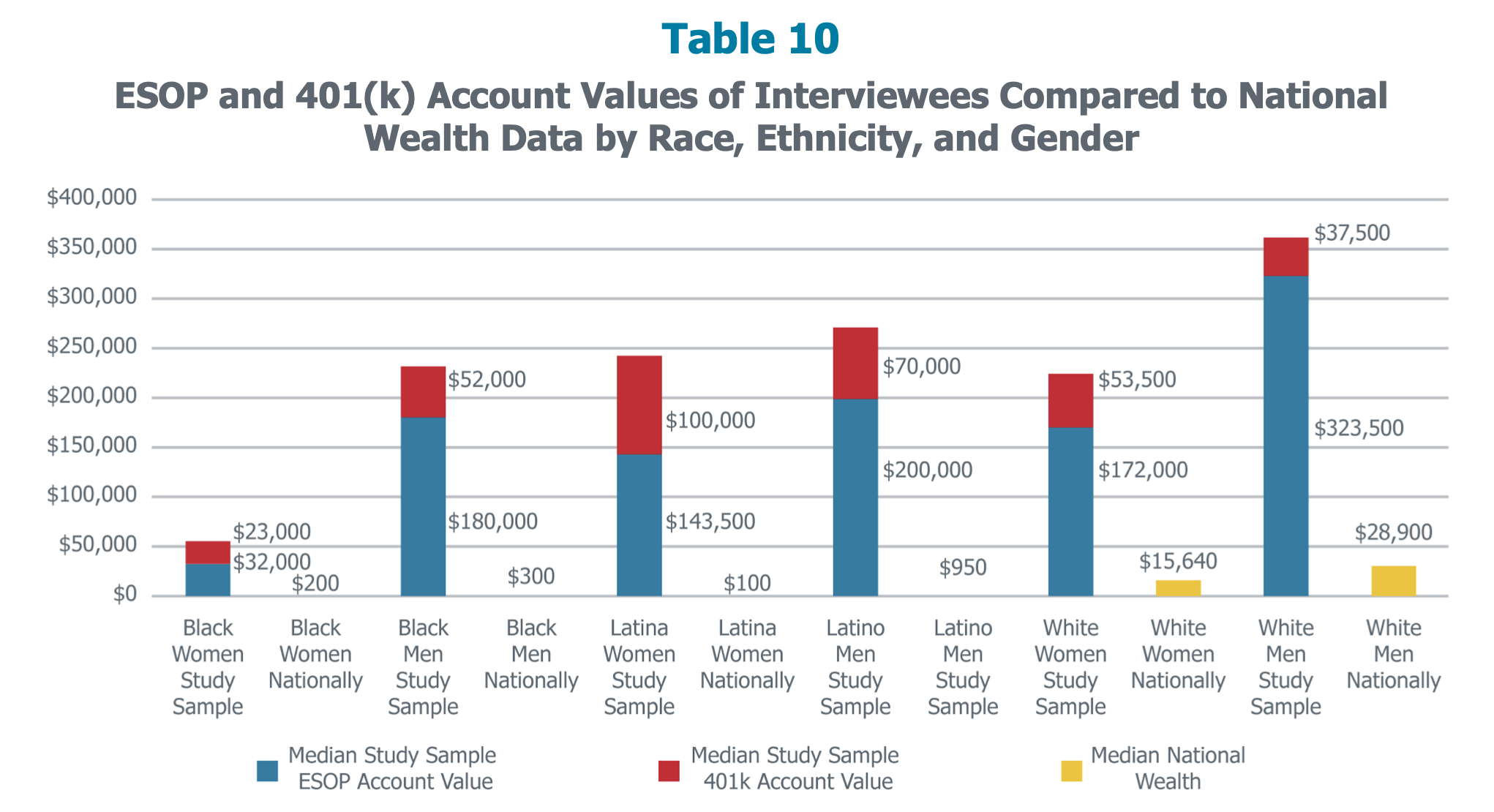

For example, a national study from the Survey of Consumer Finances of 21 American companies found a significant median increase in ESOP retirement account balances relative to the American average:

The low- and moderate-income workers in the companies had ESOP account values ranging from $15,000 to $6,000,000 per worker, with a median value of $165,000. By contrast, the typical American household at the 50th percentile median had just $17,000 in savings. Of the low- and moderate-income workers surveyed, those closest to retirement (ages 60 to 64) had 10 times more wealth compared with the typical American in that age group.viii

Recently, firms’ varying responses to the COVID-19 pandemic have exemplified the social value of employee-owned companies. According to recent data, employee-owned firms significantly outperformed other firms through the pandemic when it came to protecting worker health and safety, retaining employees, and maintaining hours and compensation. In fact, this difference was up to 3.2 times greater for employee-owned firms compared to others.

These benefits may arise from employee-owners’ increased participation in training and aspiration to stay in the workplace, more innovative ideas from employees, and greater awareness of common workplace culture and sharing information. Together, this evidence indicates that employee ownership and financial participation in firms can be an important tool for business resilience and job retention in communities. It also has the capability to support economic recovery at both national and employee levels.

Governance

Third, employee-owned firms show greater performance in terms of governance standards. For example, employee ownership is associated with improvements in stakeholder management by increasing employee involvement. After considering firm size and sector, researchers found that heightened employee involvement in employee-owned firms has a significant impact on the quality of external responsible stakeholder management. However, it is important to note that while the researchers established a strong correlation, there was not sufficient evidence to establish one-way causation.

Additionally, positive effects were particularly strong when firms included their employees not only through financial participation, but also in the decision-making process. Other studies found that this synergistic combination was essential to seeing the governance benefits of employee-ownership: employee ownership had little influence on motivation without representation at the board level.

Together, these mechanisms encourage greater employee engagement and peer accountability. ESOPs can therefore improve both internal and external accountability by reducing job- and responsibility-shirking behavior and increasing voluntary disclosure.

Financial Returns

In light of the many advantages of employee-ownership, do these firms sacrifice financial performance or productivity to achieve their ESG benefits? One meta-analysis of 102 studies across nearly 57,000 firms and several countries finds a small but significant positive relationship between employee ownership and productivity, pay, and firm survival. Although causation has yet to be determined, researchers found that generally positive relationships remained even after controlling for unknown factors and statistical corrections.

Many studies have attempted to identify the drivers and impacts of financial performance among employee-owned firms – from levels of innovativeness, participation effects, commitment effects, and more.

As of yet, and despite significant research investment by groups such as the National Center for Employee Ownership, there has been no clear consensus on a simple relationship between employee ownership and performance. Variables such as firm size, type of industry, industry growth, and level of industry instability create variations in overall performance. However, even amidst this growing subject of research, few studies have found a strongly negative correlation between employee ownership and firm performance – suggesting that, at the very least, employee financial participation may not lead to significantly worse returns.

Criticisms

Despite the positive potential of ESOPs, this organizational model is not without its drawbacks. Common criticisms of employee-owned firms include the free-rider problem of employees who lack motivation once enrolled in ownership plans, the difficulty of implementing an employee ownership structure that creates effective performance based on firm size and type, and financial risk from reduced diversification in employees’ stock ownership portfolio.

Furthermore, the tendency towards high averages of employee retention may create conflict between executives and human resources officers wishing to incentivize certain performance or avoid the free-rider problem. Researchers define the “free-rider problem” (also known as shirking) as the weakening links between an employee’s effort and their reward as the number of employee-owners increases.

However, several cultural factors within employee-owned firms help counteract these challenges, including increased peer pressure on a free-riding co-worker. Additionally, HR policies that encourage participation can reduce the negative shirking effects, such as being in an employee involvement team, job security, and training.

Discussion & Conclusion

These results have important implications for those interested in expanding ESG investments and impact investing. Some groups call for greater inclusion of employee-owned firms in investors’ portfolios given their demonstrable contributions to employees, the environment, and their stakeholders.

As anecdotal evidence amidst this wide array of statistics and studies, I found my own experience with an ESOP-based firm to be incredibly valuable, with a strong culture and buy-in from employees throughout the organization. Students starting to recruit for their first jobs or experienced graduates looking to transition roles should consider companies with ESOPs or other forms of financial participation as a method of increasing their own job security and economic stability, particularly in times of uncertainty or crisis. These considerations are more important than ever in today’s ambiguous and constantly changing economic environment.

By Kristin Tingle

Views and opinions expressed here are those of the author and do not necessarily reflect the official position of the ESG Initiative at the Wharton School or the Wharton School.

Turner ESG Fellows

Turner ESG Fellows are a group of 20-25 undergraduates across Penn who participate in a year-long program of speaker sessions, networking opportunities, and professional development across many ESG topics. Alongside their peers, they develop a working knowledge of real-world environmental, social, and governance topics, learn about different ESG career options both in academia and industry, and network with other students, faculty, and professionals. They also benefit from mentorship and community-building opportunities, led by our returning Turner ESG Senior Fellows.

Kristin Tingle,

W ’23 C’23

Kristin is a 2023 graduate of the Huntsman Program in International Studies and Business, with concentrations in Decision Processes and Strategic Management and a target language of French. Kristin is a member of the Turner ESG Fellows as well as other organizations on campus, and she enjoys exploring sustainable solutions for complex global problems, diving into language immersion, and travel.

The support and vision of impact investor Bobby Turner, W’84, catalyzed the launch of the Turner Environment, Social and Governance (ESG) Fellows.

As a longtime supporter of social impact activities at Wharton, Turner – CEO of Turner Impact Capital – is an example of, as Joseph Wharton said, harnessing the power of business to “solve the social problems incident to our civilization.” He also helps inform the ongoing priorities and future direction of the Wharton School as a member of the board of overseers. The ESG Initiative is very grateful to Lauren Golub Turner, W’85, and Bobby Turner, W’84 for their support.