Analyzing global conflict in November

In this month’s blog, we will demonstrate the Wharton ESG Initiative’s Business and Conflict Barometer’s (BCB) ability to examine monthly sentiment score data surrounding conflict, as well as help visualize the dynamics of conflict pressures over time. Based on the combination of results from our public media analysis and the sentiment scores, this blog discusses whether conflicts are increasing or decreasing for a particular event, place, region, or sector, combined with examples of changes in previous score trends and possible explanations.

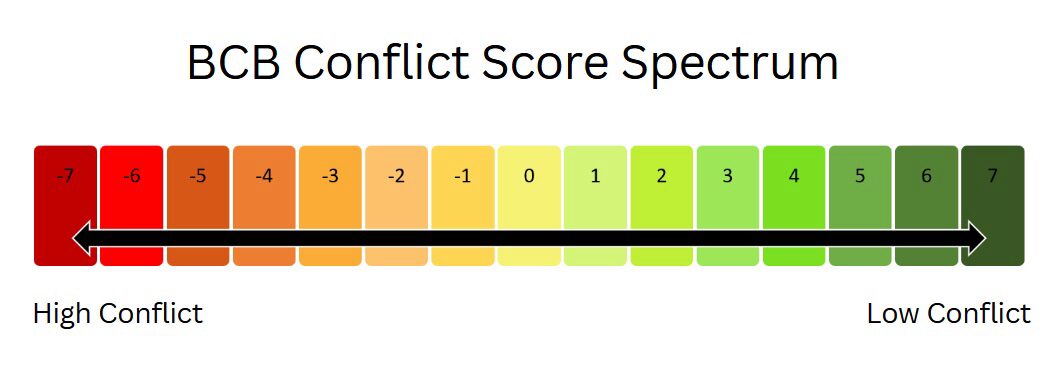

The data results of the BCB analysis are measured as coefficients on a scale from -7 (very high conflict pressures) to +7 (no conflict pressures) at a specific date and place alongside the topics or themes associated with that conflict. For example, a region or actor experiencing high degrees of conflict (war, government instability, economic damage, etc.) will demonstrate scores below zero, such as -1 and -3, while low or no degrees of conflict (economic prosperity, environmental growth) will show scores above zero, such as 1 or 2. A neutral score of 0 reflects neither high nor low conflict occurrence. Although the scores range from -7 to 7, they are relatively normally distributed, meaning that even a deviation of -2 or 2 is an indicator of significant conflict-related media coverage at the country-level.

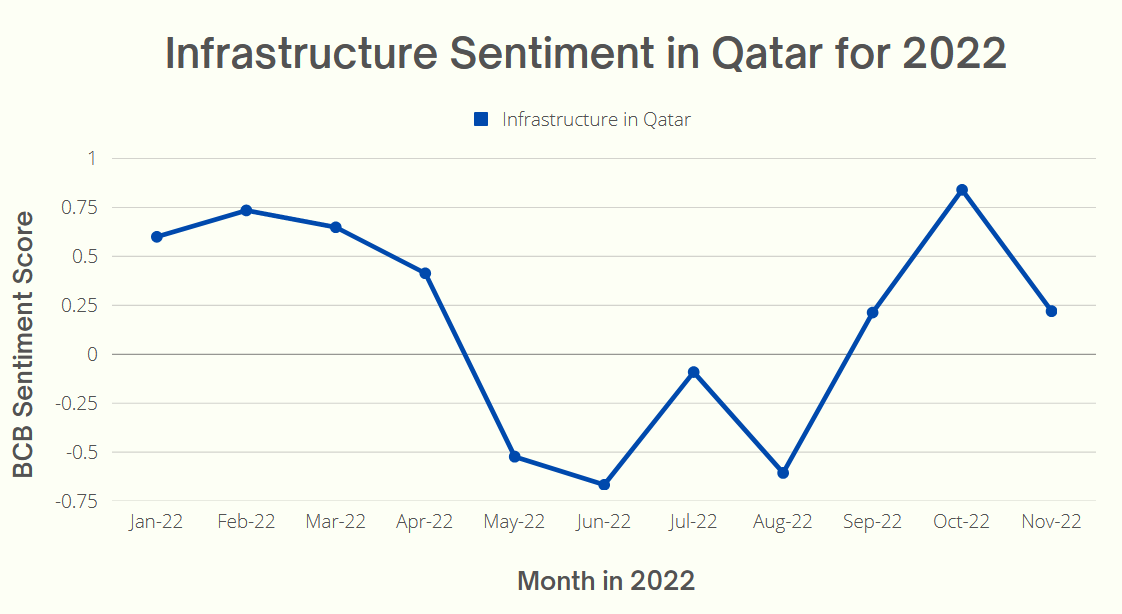

November has brought the FIFA World Cup to the forefront of news this month, and alongside side it, media reports on the presence of human rights abuses in Qatar. With hundreds of thousands of migrants brought in for the construction of the stadiums and housing projects in the country for the event, there has been much backlash and negative sentiment surrounding migrant workers’ rights and living conditions since earlier this year. The infrastructure sector, pictured in the graph below, encompasses the construction, home builders, and real estate industries, according to the relevant SASB standard.

These industries have experienced high levels of conflict this year, particularly since May 2022 when Amnesty International published a damaging public report that urged FIFA to pay nearly half a billion USD to compensate migrant workers. During this month, the sentiment score dropped from a positive score of 0.414 to a negative score of -0.523, indicating a drop from prior non-conflictual media coverage to the negative emergence and urgency of the country-level situation. Since then, sentiment has remained relatively negative or low, teetering around a neutral sentiment score of 0, despite a slight improvement in coefficients since August, before falling again with the start of the tournament in November 2022.

In addition, the BCB can also be used to identify trends in economic patterns across countries. For example, in November, many countries continued to face precarious economic conditions. In Myanmar, the consequences of the ongoing civil conflict have severely depleted the nation’s financial sector, which was hit by a blacklist by the international organizational FATF (Financial Action Task Force), followed by national-level blacklists such as from Russia. The regulatory measure aimed to deplete funding for opposition groups and the regime alike, as UN Secretary Antonio Guterres spoke of the “unending nightmare” in Myanmar during a speech in Cambodia last month. Our data from the BCB reflected this conflict by recording very low, negative scores for the country’s financial sector at -2.7, down from -2.1 in October 2022. This made the country a severe outlier among other Southeast Asian states, which otherwise had neutral or slightly negative coefficient scores, indicating a lack of a high-conflict environment.

Meanwhile, in Sri Lanka, which is still battling its worst economic and political crisis since British independence, new budget introductions last month were made in an attempt to stabilize the economy and hold rates amid growing inflation. The country demonstrated unusually low sentiment scores for financials of -2, albeit slightly up from the peak of the crisis a few months ago. Similarly, the Czech Republic has scrambled to impose windfall taxes of over 60% on key banks and energy companies to combat growing inflation and the biggest electricity price increases in the EU. The extractives sector, which includes most energy (oil and gas) industries, dipped to a very low -2.9 sentiment, alongside a -1.8 coefficient for the financial state of the country.

Hungary joins Sri Lanka, the Czech Republic, and four other countries in being named as at a high risk of currency crises by Nomura in November 2022. Hungary has a very low financial score of -2.2 made it significantly stand out amongst its European neighbors, including those suffering the consequences of the war in Ukraine. An IMF report released last month concluded that Hungary was not tightening its monetary policy enough since last year, as public debt remains high and fiscal and current accounts remain in deficit. The economy continued contracting quickly, sparking fears of a recession. Such concerns also come in light of the EU’s attempts to thaw bilateral relations with Hungary.

Finally, this month we wish to highlight the negative sentiment calculated by the BCB surrounding extractives and infrastructure in the Pacific Island nations, including Tuvalu, Vanuatu, the Solomon Islands, Nauru, the Marshall Islands, and Tonga. In Tuvalu, the country has continuously been facing an existential threat due to climate change and rising sea levels. This month, it made headlines for saying that the island nation is rebuilding itself in the Metaverse while its citizens will be forced to migrate elsewhere. In conjunction with Vanuatu, where climate change is also forcing migration out of the island, both countries demanded a fossil fuel non-proliferation treaty and a damage fund at the COP27 event that occurred last month. For all of the abovementioned island nations, sentiment scores remained negative and low, around -1.8, indicating urgent concern about the high degree of conflict present in these countries.