Analyzing weakening economic conditions in December 2022

In December 2022 as the media reported on widespread cost of living crises and growing interest rates, the Business and Conflict Barometer (BCB) conducted public media analysis by listening into news and reports from think tanks, advocacy groups, and corporate reports. The results of that analysis provide a granular view of global weakening economic conditions linked to rising prices and threats of a recession for particular events, locations, and sectors.

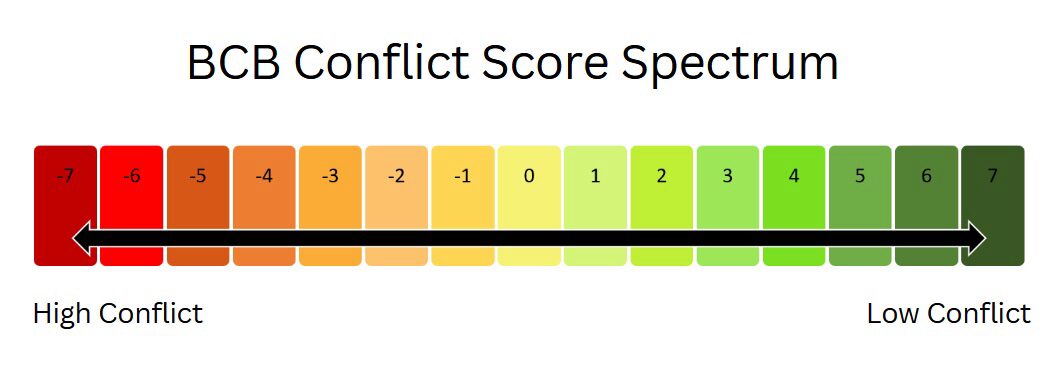

The BCB communicates the level of conflict pressure through a sentiment score measured on a scale from -7 for very high conflict pressures to +7 for no conflict pressures. A neutral score of 0 reflects neither high nor low conflict occurrence. Scores are relatively normally distributed, so even a deviation of -2 or +2 is indicative of significant conflict-related media coverage. For example, a region or actor experiencing high degrees of conflict through war or government instability will demonstrate scores below 0, such as -1. While experiencing low or no degrees of conflict through economic prosperity or environmental growth, they will demonstrate a score such as +1.

As countries globally attempted to recover their economies to pre-COVID conditions, the Russian invasion of Ukraine exacerbated the already precarious economic conditions in several countries, for example through the increased volatility of oil and gas prices. Additionally, the strict Covid-19 lockdowns in China have further hampered the global supply chain further worsening economic conditions.

The cost-of-living crisis in the United Kingdom has been growing since early 2021 and garnered significant media coverage recently as tensions have boiled over. In October 2022, citing the increase in prices, the UK’s highest inflation rate in the past 40 years, and their below-inflation pay, the country’s nurses and rail workers went on strike to demand better wages to combat the cost-of-living crisis. The BCB sentiment score illustrated this rise in conflict; from September to December, the sentiment score dropped from -1 to -1.76 for the healthcare sector and from -0.25 to -0.85 for the transportation sector. As inflation rates have dropped slightly, we see an improvement in the country’s sentiment score for the financial sector which increased from -0.70 to -0.01. This suggests that while the cost-of-living crisis remains unstable and the strikes ongoing, the holistic perception of the British economy in the media has improved.

Japan provides another example of a country suffering a cost-of-living crisis, as core consumer prices increased at the highest annual rate in the past 40 years in 2022 while wages remained stagnant. Kristalina Georgieva, the Managing Director for the International Monetary Fund, warned Asian countries at the ASEAN+3 forum, including Japan, about inflation being a “pressing global challenge” and that “inflationary pressures in the region [Asia] are rising.” This concern aligns with Japan’s worsening BCB financial sector sentiment score, down from -0.15 in November 2022 to -0.72 in December 2022.

To curb these growing economic pressures, central banks in several countries have significantly increased their interest rates in the latter half of 2022 to dissuade consumer borrowing and spending in an attempt to decrease the inflationary pressures. For example, as Australia struggling with high prices, as demonstrated by a financial sector sentiment score of -0.45 in December 2022, the Research Bank of Australia increased its rates to a 10-year high of 3.1%.

In December 2022, the BCB data identified topical issues and concerns such as the worsening economic conditions in several countries due to inflation. In addition to economic concerns, the BCB also reflects political tensions and conflicts. By using the BCB, we can assess conflicts in several industries for any given region and time making it a valuable tool for policymakers, researchers, and investors seeking to learn about the intersection of business and conflict.